Introduction

Entrepreneurial activities offer a wide range of benefits, but financial difficulties such as debt or account freezes can make starting or continuing a business considerably more difficult. In such cases, the USA can be a particularly attractive alternative. This article looks at how and why the US is particularly advantageous for entrepreneurs in financial distress.

Financial challenges in Germany

In Germany, a Indebtedness or setting up an attachment protection account (P-account) can severely restrict your financial freedom of movement. Although a P-account makes it possible to protect a certain amount from seizure, access to larger sums and associated investments remains restricted. This is a significant obstacle for budding entrepreneurs, as they often need to access capital to start or expand their business.

Problems with setting up a company in Ireland

Ireland offers a number of advantages for company foundersThe Irish economy is particularly attractive due to its friendly business environment and attractive tax rates. However, there is one major problem: Irish Banks are part of the international data exchangeThis means that information about bank accounts and financial transactions is passed on to Germany. This means that the German tax office becomes aware of the accounts and transactions of an Irish company and can initiate measures such as account freezes or seizures. This makes entrepreneurial activity considerably more difficult and makes setting up in Ireland unattractive for indebted German entrepreneurs.

Setting up a company in the USA as a way out

For people in financial need, the Founding a company in the USA is a practicable solution. American banks and authorities are not obliged to pass on information about bank accounts or financial circumstances to Germany. This creates a certain anonymity and enables indebted entrepreneurs to implement their business ideas without the hurdles of the German financial system.

The legal and practical aspects of incorporation in the USA

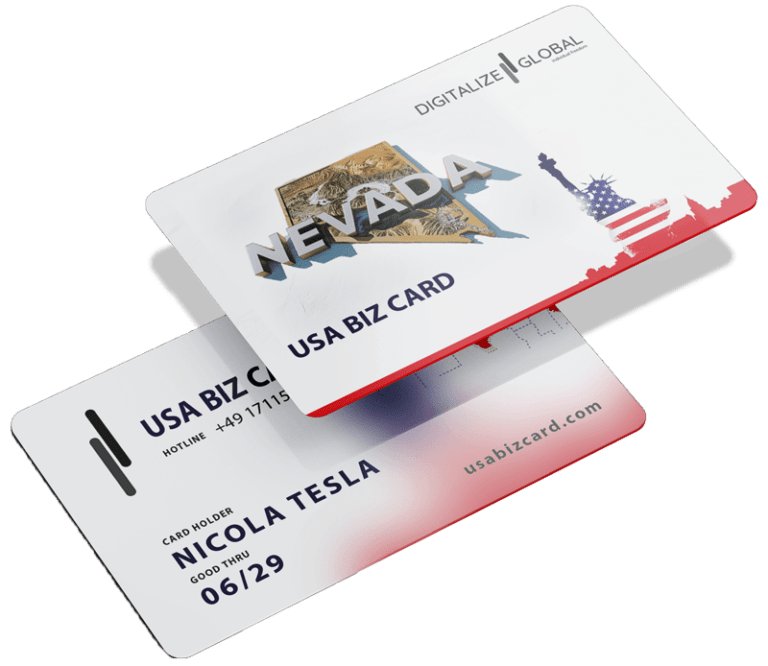

The Setting up a company in the USA is attractive for several reasons. Firstly, many US states, such as Delaware and Nevada, provide a favorable legal framework for entrepreneurs. These states are characterized by simple incorporation processes and low corporate taxes. Secondly, it is relatively easy to set up a US limited liability company (LLC), which offers flexible legal protection.

Tax advantages and international business opportunities

Another key advantage of setting up a company in the USA are the tax Incentives. The US offers a variety of tax benefits that allow entrepreneurs to minimize their tax burden. In addition, setting up a US company opens up international business opportunities that facilitate access to global markets and increase competitiveness.

Conclusion: seizing opportunities despite financial difficulties

Despite financial difficulties in Germany offers company formation in the USA remarkable advantages. The USA is a particularly attractive option for entrepreneurs in debt who want to realize their business ideas without restrictions. With the right information and planning, these entrepreneurs can overcome their financial hurdles and successfully build a new business.