Wyoming

When looking for the best conditions for forming a Limited Liability Company (LLC) in Wyoming, the question of the best state often arises. Wyoming is considered one of the leading options for non-domicil LLCs. In this article, we will do an in-depth analysis of the pros and cons of Wyoming as a location for foreign LLCs and discuss whether it is indeed the best state for this purpose.

Tax advantages

Wyoming offers no income tax, which is attractive for LLC owners. is. In addition, there are no corporate taxes, taxes on interests and dividends, inheritance taxes or taxes on assets.

Low annual fees

The annual fees for the maintenance of a LLC in Wyoming (franchise fees) amount to only approx. $50, which is Wyoming makes it a very cost-effective option.

Legal protection

Wyoming provides a high degree of legal protection for LLC owners because they are not personally liable for Debts or obligations of the company.

Examples

Many international companies, including well-known Brands such as Google, Coca-Cola and Amazon, have registered subsidiaries as LLCs in Wyoming to take advantage of the tax benefits and legal protection.

Comparison with other states

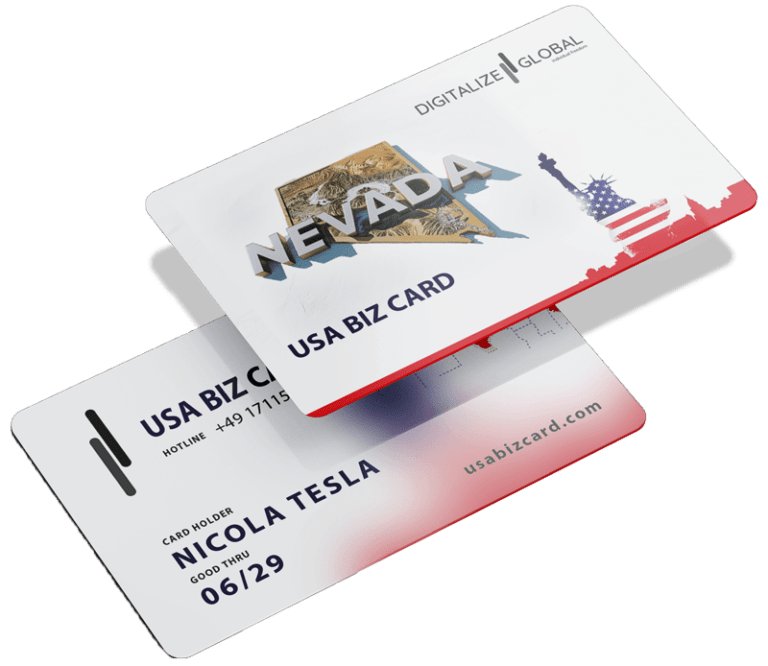

Other states such as Delaware or Nevada offer LLC-friendly benefits, such as the Delaware General Corporation Law (DGCL) or protection from personal liability. It is important to carefully weigh the benefits of each state to find the best option for individual business needs.

LLC formation by experts

Affordable LLC company formation, also payable in installments!

Also anonymous company formation in the USA!

Found a company in the USA with a bank account as investment protection or as a start-up for your online business idea!

Anonymity and data protection

A frequently cited advantage of Wyoming is the high level of discretion and anonymity that the state offers. Entrepreneurs are required to disclose significantly less personal information during the start-up process than in many other states. This can be attractive to some foreign investors.

In Wyoming, certain business structures, such as Limited Liability Companies (LLCs), can provide relative anonymity. This is because Wyoming does not require disclosure of beneficial owners for LLCs. Instead of disclosing the actual owners, Wyoming businesses can appoint a so-called "registered agent" who is listed in the state's records as the contact person for the company.

Possible disadvantages

However, it should also be noted that Wyoming may not offer the same legal certainty as Delaware, which is known for its experience in corporate law. In addition, the anonymity in Wyoming could make it more difficult to prove corporate identity, which could be problematic in some business areas.

Comparison table

Cost comparison in (USD) Chart

Here are the standard fees that normally apply. Special cases and additional services are not listed

Conclusion

Although Wyoming one of the most attractive options for foreign LLC formation is, every entrepreneur must carefully examine their specific needs and requirements in order to find the ideal solution for their company. It is advisable to seek advice from an expert in order to thoroughly understand the tax, legal and data protection aspects and make the right decision. Locations such as Delaware or Nevada can be considered, depending on the individual company objectives.